Understanding Transparent OLED and Its Key Advantages

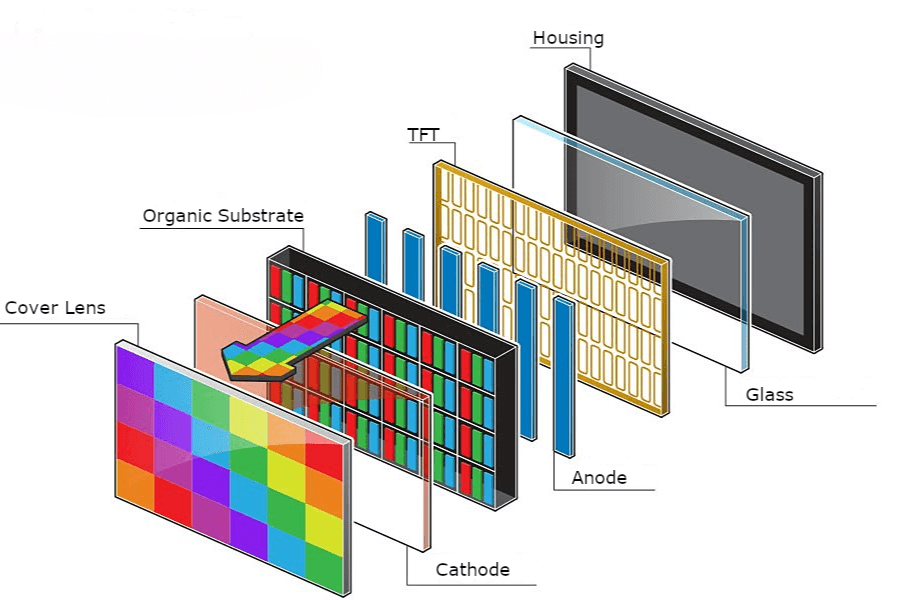

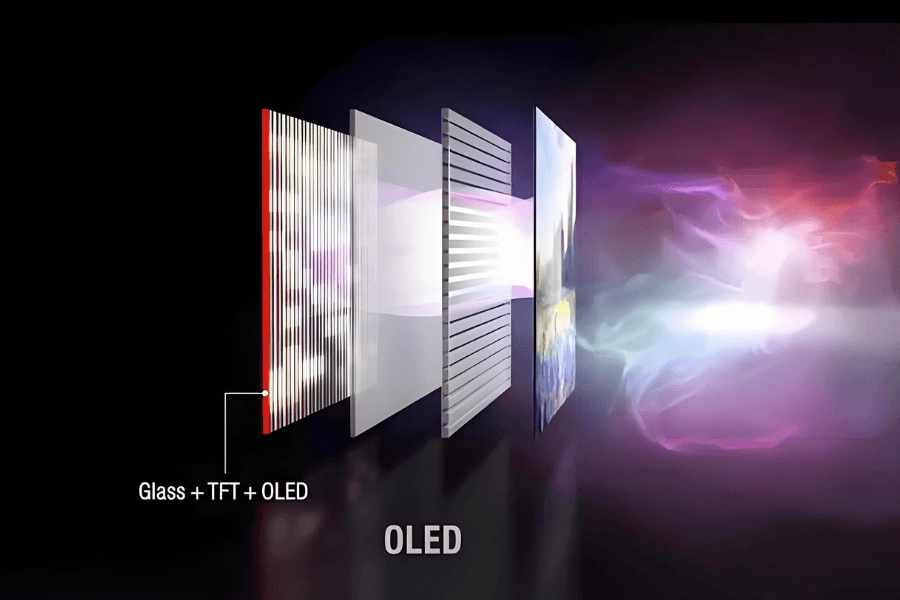

Transparent OLED is a self-emissive display technology that becomes clear when inactive and delivers vivid digital content when illuminated. Each pixel produces its own light which removes the need for a backlight. This approach keeps the panel thin and lightweight which supports a wide range of glass-based installations.

Modern Transparent OLED panels provide strong contrast, wide viewing angles, and fast response times. Transparency levels now reach about 45 percent in some microdisplay formats. These characteristics support curved layouts, movable partitions, and surfaces that merge physical and digital environments. Power use stays efficient because the display activates only the pixels that are needed.

Manufacturing follows three main steps. Substrate preparation creates a clean and stable base for the display layers. Organic materials are deposited to form uniform light-emitting elements. Thin-film encapsulation protects these materials from moisture and oxygen which helps maintain long-term reliability.

How This Appears in Real Installations

Retail designers often embed Transparent OLED into storefront glass to show real-time promotions without blocking physical products.

Key Takeaway

Transparent OLED combines design flexibility with optical clarity that is difficult to achieve with traditional display systems.

Market Outlook for Transparent OLED From 2024 to 2035

The Transparent OLED market is entering a period of rapid expansion as transparent displays gain momentum in retail, automotive, public spaces, and premium consumer electronics.

Most industry estimates place market value between 2.3 and 6 billion dollars from 2023 to 2025. Long-term projections extend much higher with forecasts that range from 12 billion dollars to more than 245 billion dollars by 2035. These differences reflect adoption speed, production scale, and the role of new applications such as AR-integrated displays. Growth expectations generally fall between 18 and 45 percent CAGR which places 2025 through 2035 as the strongest development window.

How This Appears in Real Installations

The rollout of Transparent OLED TVs and commercial signage in Asia and Europe has increased interest from shopping centers and transportation hubs.

Key Takeaway

The Transparent OLED market is evolving quickly due to manufacturing improvements and wider acceptance of transparent visual interfaces.

What Drives Transparent OLED Adoption and What Holds It Back

Several forces are moving the Transparent OLED market forward across industries.

Drivers

- Growing demand for transparent TVs, smart appliances, and concept devices

- Automotive digitalization including heads-up displays and next-generation cockpit layouts

- Expansion of retail digital signage and interactive storefront experiences

- Increased use of AR and VR hardware that benefits from transparent microdisplays

- Public investment in transportation upgrades and smart-city development

Barriers

- High production cost for large or high-resolution panels

- Yield challenges during manufacturing

- Sensitivity to water and oxygen that requires strong protection

- The need for specialized content and planned system integration

How This Appears in Real Installations

A Transparent OLED system in a high-traffic mall may require custom hardware, adapted content, and long-term maintenance planning which increases total project cost.

Key Takeaway

Adoption continues to grow but real-world deployment requires balanced planning that considers budget, environment, and system complexity.

Where Transparent OLED Displays Are Used Today

Transparent OLED adds value where digital information needs to appear without blocking visibility.

Consumer Electronics

Transparent TVs, refrigerator displays, and concept phones present information while blending into interior spaces. Designers use Transparent OLED to reduce visual clutter and integrate displays directly into furniture or architecture.

Retail and Commercial Spaces

Storefronts and display cases use Transparent OLED to highlight products while showing pricing or brand stories. This approach improves engagement without disrupting sightlines or natural lighting.

Automotive and Transportation

Head-up displays, side-window overlays, and cockpit elements use Transparent OLED to inform drivers while maintaining road visibility. Lightweight construction supports electric and autonomous vehicle platforms.

Aerospace

Transparent partitions and cabin panels reduce weight and support flexible cabin designs. Integrated display elements can show safety information or ambient content.

Public Infrastructure

Transit systems use Transparent OLED for route maps, arrival times, and cultural interpretation. Museums display layered information over artifacts.

Medical and Industrial

Transparent interfaces allow teams to view equipment or patients while receiving real-time diagnostic or workflow data.

How This Appears in Real Installations

Some metro systems now present navigation and arrival information directly on Transparent OLED windows.

Key Takeaway

Transparent OLED improves environments where visibility and digital information must coexist.

Regional Insights and Growth Patterns

Asia Pacific

Asia Pacific leads the Transparent OLED market with strong panel production in China, South Korea, and Japan. These regions offer complete supply chains from materials to system integration. Retail innovation and infrastructure upgrades accelerate adoption.

North America

North America uses Transparent OLED in retail automation, corporate environments, and aviation. Technology companies test the technology in concept devices and interactive spaces.

Europe

Europe advances Transparent OLED in automotive HUD systems and premium retail. Energy efficiency rules guide display choices. Museums use transparent displays for layered interpretation.

How This Appears in Real Installations

Automotive manufacturers in Germany test Transparent OLED for next-generation windshield displays.

Key Takeaway

APAC leads production while Europe and North America expand high-value commercial applications.

What to Expect Next in Transparent OLED Technology

Several trends will guide the next phase of Transparent OLED development.

- Higher transparency levels beyond current 45 to 50 percent

- Commercially viable flexible and foldable Transparent OLED panels

- Higher resolution including 8K for architectural and automotive use

- Integration with AR systems, IoT environments, and gesture control

- Multi-layer spatial systems for storytelling or interactive retail

- Sustainability improvements in materials and power use

How This Appears in Real Installations

Concept stores already use multi-layer Transparent OLED walls that shift content based on customer proximity.

Key Takeaway

Transparent OLED is moving from single panels to dynamic spatial interfaces that respond to users and environments.

FAQ

Q1: Are Transparent OLED panels durable enough for commercial use

Transparent OLED panels use thin-film encapsulation that resists moisture and oxygen. They perform reliably in indoor environments when paired with proper handling. Typical lifetimes range from 30,000 to 50,000 hours.

Q2: Can Transparent OLED be used outdoors

Outdoor use is possible with high-brightness models though direct sunlight may reduce clarity. Anti-reflective coatings, sensors, and protective enclosures help maintain visibility.

Q3: Why can Transparent OLED not reach full transparency

Organic layers and conductive materials block part of the light. Commercial panels achieve about 45 to 50 percent transparency which balances clarity and contrast.

Q4: Will Transparent OLED become more affordable

Costs should decline as production scales. Larger reductions are expected after 2027 as yield rates improve and supply chains expand.

Q5: Is custom sizing or shape modification possible

Yes. Many suppliers offer custom shapes and integration formats for retail, automotive, and architectural environments.

RUSINDISPLAY Soft Positioning

RUSINDISPLAY provides professional OLED and Transparent Display solutions that support modern retail, commercial spaces, and architectural environments. Our systems combine stable performance with rapid 3D scene creation and a Tech in Nature design approach that blends digital layers with physical surroundings. With support from more than 120 global brands, we help businesses increase foot traffic, strengthen engagement, and achieve fast ROI through reliable technical guidance and responsive after-sales service.